Management Systems meru

Over the course of many breakfasts, the pair discussed their careers, their firms, and what they both saw as an unmet market need. From transactions to transformations, MERU brings functional and industry expertise, a group of veteran operators, and an incentive-aligned approach to any situation. Former Deloitte Consulting with experience in strategy, operations, and performance in financial services. Former Deloitte Consulting with experience in M&A and Performance Improvement across a variety of industries, including energy and manufacturing.

Thought leadership from the MERU team, media appearances, podcast visits, news article mentions, and more. Served as Chief Restructuring Officer to outdoor equipment & apparel retailer through its successful Chapter 11 sale process, which won TMA’s Transaction of the Year award in 2018. Former BCG, Lilly supports key recruiting and operations initiatives across the suspense definition and meaning firm.

Sign in to see who you already know at Meru Consulting Limited

He has experience with industrial logistics and data analytics, driving creative solutions to complex business problems. MERU’s Strategic Partner network is comprised of 130+ industry and functional subject matter experts. Our Strategic Partners are an integral part of the MERU team and allow us to get up to speed quickly and focus on the areas of highest potential impact to rapidly identify and capture value.

Our consultants have successfully led large organisations through significant changes including the introduction of new event management systems and new Safety standards. Experienced data and analytics professional with a background in developing analytical practices to help deliver insights and solutions across tech, government, and CPG. Whether you require an entire HSE System developed and implemented, a procedure reviewed or a Management Plan drafted, the team at Meru are your one stop shop for Management Systems. Our on the ground experience in developing, implementing and maintaining HSE Management Systems means we deliver practical and sustainable systems.

Meru Consultancy Services

- Served as Chief Restructuring Officer to outdoor equipment & apparel retailer through its successful Chapter 11 sale process, which won TMA’s Transaction of the Year award in 2018.

- Experienced in financial services and data analytics driving creative solutions to complex and highly regulated business problems.

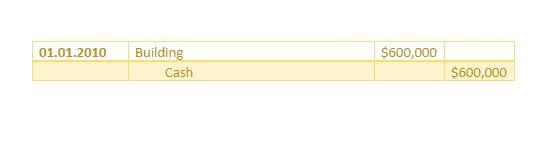

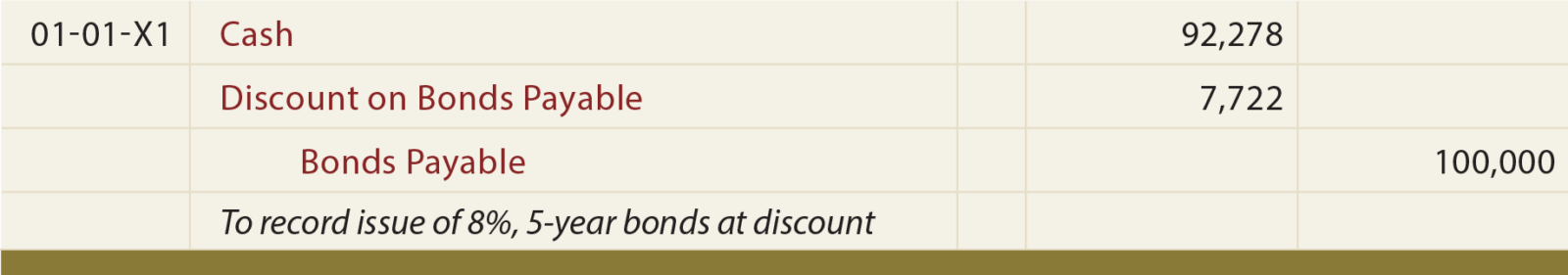

- Former “Big 5” public accountant with experience advising clients on technical accounting topics, internal controls over financial reporting, and other public company reporting matters.

- All the while, the team remains focused on attracting high-quality people who share the same set of core values and doing impactful work for its clients.

- From two partners to four; from zero strategic partners to over 130; from zero engagements to dozens.

- Former CapTech with experience in data visualization and data engineering across various industries including logistics, financial services, and sports and entertainment.

We can lead the change on your behalf or assist you to implement changes by developing practical Change Management systems and procedures. Our proven strategies will ensure that changes in your organisation transition smoothly and minimise harm to people and the environment. Eddie is a senior financial advisory professional, with over 15 years experience. Sloan is a Data Analyst in the Data Insights Practice, and he has experience in financial services and healthcare.

Energy & Environmental Design Services, LLC

Drawing on our deep bench of highly experienced turnaround professionals, we work quickly to restore stability, identify and unlock trapped value, and chart a course back to long-term sustainability. From two partners to four; from zero strategic partners to over 130; from zero engagements to dozens. All the while, the team remains focused on attracting high-quality people who share the same set of core values and doing impactful work for its clients. Former Deloitte Financial Advisory with experience in turnarounds & restructuring as well as corporate finance across a variety of industries including manufacturing, media, hospitality, and building products.

Former EY Data and Analytics Consultant with experience in data visualization and data analytics to provide businesses with data-driven insights and decision-making tools. Former Deloitte Consulting with experience in data analytics, data visualization, and backend data engineering in the life sciences and technology industries. Experienced in financial services and data analytics driving creative solutions to complex and highly regulated business problems. Former BCG with experience in regulatory compliance, finance, and strategy across a variety of industries including financial services and industrial. Large incumbents were increasingly focused on lucrative bankruptcy administration projects, where incentives were aligned towards dragging out cases and generating billable hours. Top management consulting firms offered differentiated operational expertise, but at high prices and without shoulder to shoulder partnership.

We bring deep insights and subject matter expertise to complex situations, delivering high-impact, cash-oriented outcomes to every client we serve. Our senior leaders hail from the world’s leading turnaround and restructuring organizations. We have consistently delivered successful outcomes in highly complex situations, and bring an impact-first, cash-oriented mindset to every client we serve. The information contained on this website is provided for informational purposes only and is not intended as a substitute for professional advice. Decisions based on information contained in this website are the sole responsibility of the visitor. All material on this website is the intellectual property of what is the break-even point Meru, LLC (“MERU”, “we”, “us”, “our”, or “the Company”).

We are a diverse team of top industry experts and turnaround, transformation and performance improvement professionals who know employee furlough how to deliver successful outcomes in complex situations. Our complementary backgrounds and experience allow us to structure bespoke solutions for our clients, situation by situation. We live and breathe a set of core values that promote excellence, experience, collaboration and total alignment with our colleagues and clients. We are a team of seasoned professionals, operational experts, and industry veterans.

Management Systems meru Read More »